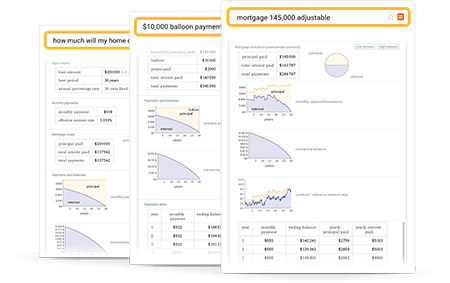

Wolfram|Alpha is an excellent tool for calculating the total cost, monthly payments and other costs and times associated with common mortgage types. You can calculate payoff times and total interest payments; generate plots and monthly payment tables showing balances over time; and dynamically compute the effects of different down payments, interest rates and mortgage types.

Online Mortgage Calculator

Compute mortgage costs and payoff times with Wolfram|Alpha

Simple yet powerful mortgage research and computation

Learn more about:

Tips for entering queries

Enter your queries using plain English. Your input can include complete details about loan amounts, down payments and other variables, or you can add, remove and modify values and parameters using a simple form interface.

Understanding mortgage calculations

Wolfram|Alpha can perform useful computations related to common mortgage types.

In a fixed-rate mortgage, the interest rate remains the same over the life of the loan; in an adjustable-rate mortgage, the interest rate is typically fixed for some period of time, but then may fluctuate in response to changing market indices that influence interest rates. Several different types (5/1, 1/1, 3/1, 7/1) of adjustable-rate mortgages and rate cap structures (5/2/5, 2/2/6, 2/2/5) are available to choose from.

The simplest mortgage calculation requires only a total loan amount, a loan period and the annual percentage rate of interest on the loan. From these variables, Wolfram|Alpha can compute monthly payments, total interest charges and breakdowns of payments against the principal loan amount and interest over the life of the mortgage. By adjusting loan amounts and interest rates as well as different down payment amounts, you can determine the size of mortgage you might be able to afford and calculate recurring costs over time.

Mortgage computations can also include additional features and variables. Points (also called discount points or mortgage points) are a way for borrowers to reduce the overall interest rate by making an up-front payment; one point equals one percent of the loan amount. A balloon payment represents a balance due at the end of the loan term. An interest-only period is a term during which all payments are counted against interest on the loan.